mississippi income tax rate

The Mississippi tax rate and tax brackets are unchanged from last year. Withdrawals from retirement accounts are not taxed.

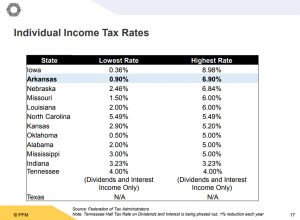

Individual Income Tax Structures In Selected States The Civic Federation

There is no tax schedule for Mississippi income taxes.

. But if legislators take no action the tax rate will remain at 4. This would mean people would pay no state income tax on their first 26600 of income a savings of about 50 a year. 0 on the first 3000 of taxable income.

These rates are the same for individuals and businesses. 5 on all taxable income over 10000. 4 on the next 5000 of taxable income.

Under House Bill 1439 the sales tax on groceries would be reduced to 45 percent on July 1 2021 to 4 percent on July 1 2024 and to half its current rate 35 percent starting on July 1 2026. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Mississippi has a graduated income tax rate and is computed as follows.

Provide up to a 5 one-time income tax rebate in 2022 for those who paid taxes. Multiply the result by 2. Social Security income is not taxed.

When the plan is fully phased in Gunn said Mississippi will have the 5 th lowest marginal rate of the 41 states with a personal income tax. 0 on the first 2000 of taxable income. Reeves said other states that have eliminated income taxes have.

Mississippi Capital Gains Tax. Reduce the state grocery tax from 7 to 5 starting in July. Any income over 10000 would be taxes at the highest rate of 5.

2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Divide the dollar amount in Item 6 of the state certificate by 100. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket.

The governor said this new law gives Mississippi the 5th lowest marginal tax rate in the nation among states with an income tax. Short- and long-term capital gains are taxed at the regular income tax rates in Mississippi. Tax rate used in calculating Mississippi state tax for year 2022.

Created with Highcharts 607. Mississippi based on relative income and earnings. Mississippi Tax Brackets for Tax Year 2021.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Mississippi Gas Tax. In subsequent years the Magnolia State would effectively impose a flat tax of 5 percent on all taxable income over.

Examples are 120 for 6000 190 for 9500 240 for 12000 If no exemptions are claimed enter 000. For income taxes in all fifty states see the income tax by state. The graduated income tax rate is.

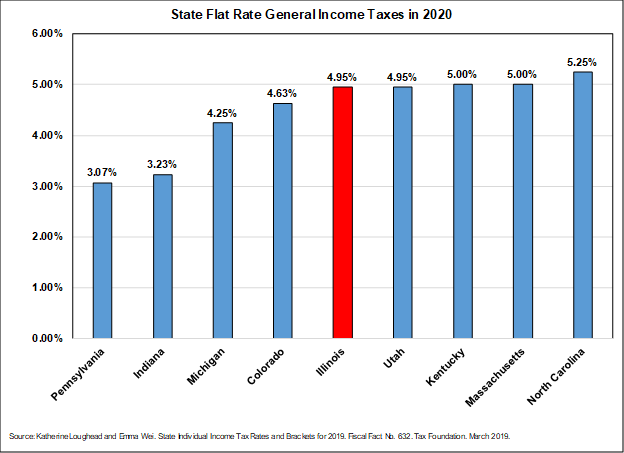

Other things to know about Mississippi state taxes The state also collects taxes on cigarettes and. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination. Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income.

Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the income tax. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. However gains from the.

For more information about the income tax in these states visit the Louisiana and Mississippi income tax pages. The Mississippi corporate tax rate is changing. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

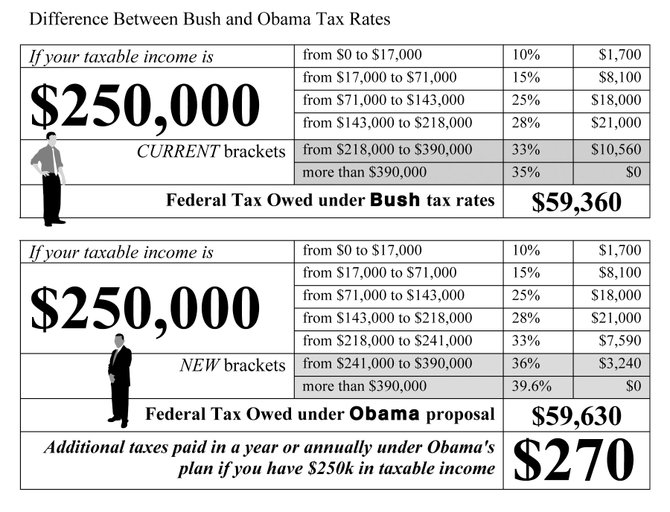

Each marginal rate only applies to earnings within the applicable marginal tax. For an in-depth comparison try using our federal and state income tax calculator. Income tax is a tax that is imposed on people and businesses based on the income or profits that they earned.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. 3 on the next 2000 of taxable income. Quick Guide to Mississippi Retirement Income Taxes.

Diesel fuel faces the same low tax of 18 cents per gallon. Mississippi is very tax-friendly toward retirees. The rebates would range from 100 to 1000.

The tax rates are broken down into groups called tax bracketsIncome tax brackets are required state taxes in. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Mississippi state income taxes are listed below. Mississippi has a graduated tax rate.

Currently groceries are included in Mississippis sales tax base and taxed at the general sales tax rate of 7 percent. In addition check out your. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5.

When coupled with the 3 percent marginal rate repeal which was fully eliminated at the start of 2022 the Senates bill would result in Mississippi levying no tax on the first 100000 of taxable income by calendar year 2026. Detailed Mississippi state income. 3 on the next 3000 of taxable income.

Wages are taxed at normal rates and your marginal state tax rate is 00. The Mississippi Senate approved legislation to reduce the state income tax by hundreds of millions of dollars Wednesday despite caution from opponents who questioned the wisdom of doing so while. Mississippi Income Tax Rate 2020 - 2021.

Regular gasoline in Mississippi is taxed at a rate of 18 cents per gallon one of the lowest gas taxes in the country.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi Tax Forms And Instructions For 2021 Form 80 105

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Strengthening Mississippi S Income Tax Hope Policy Institute

Mississippi Tax Rate H R Block

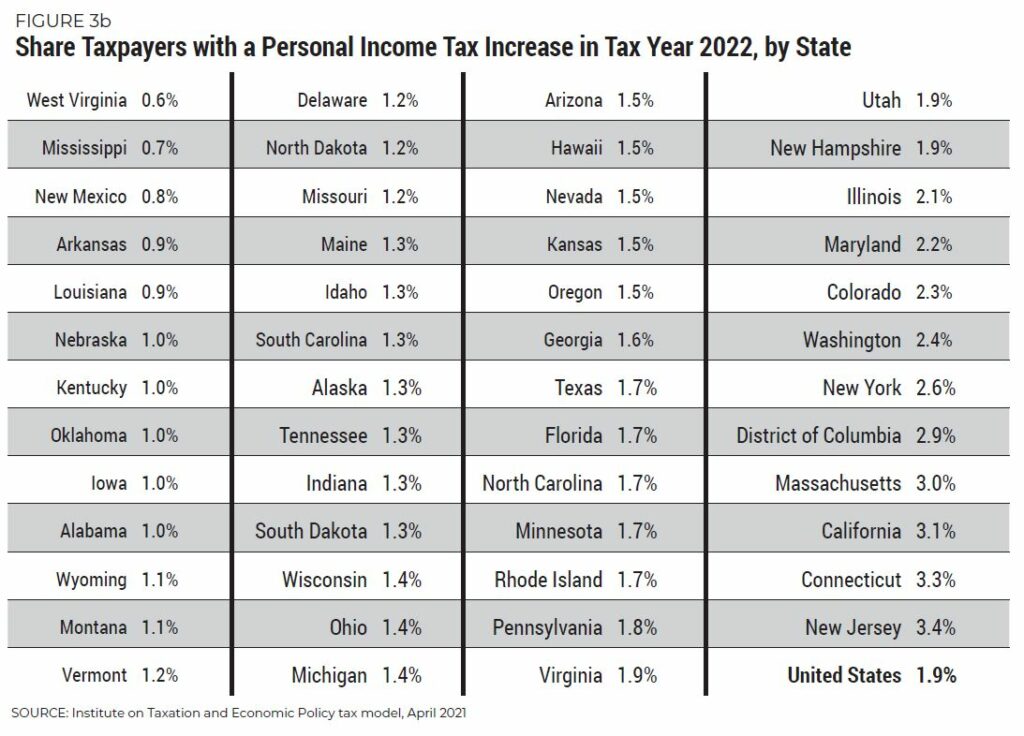

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Historical Mississippi Tax Policy Information Ballotpedia

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Mississippi Income Tax Brackets 2020

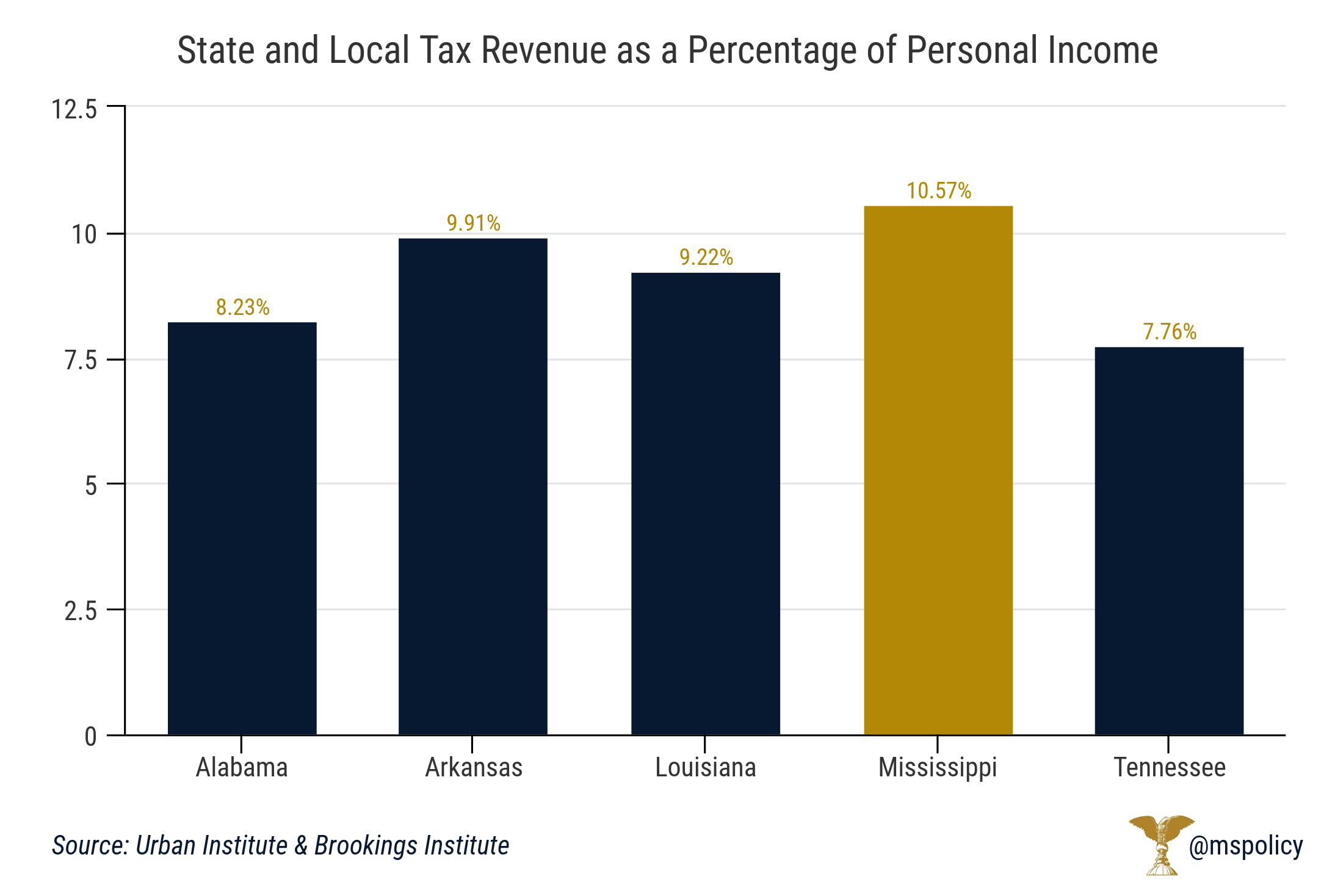

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

South Carolina S Uncompetitive Income Tax The South Carolina Policy Council